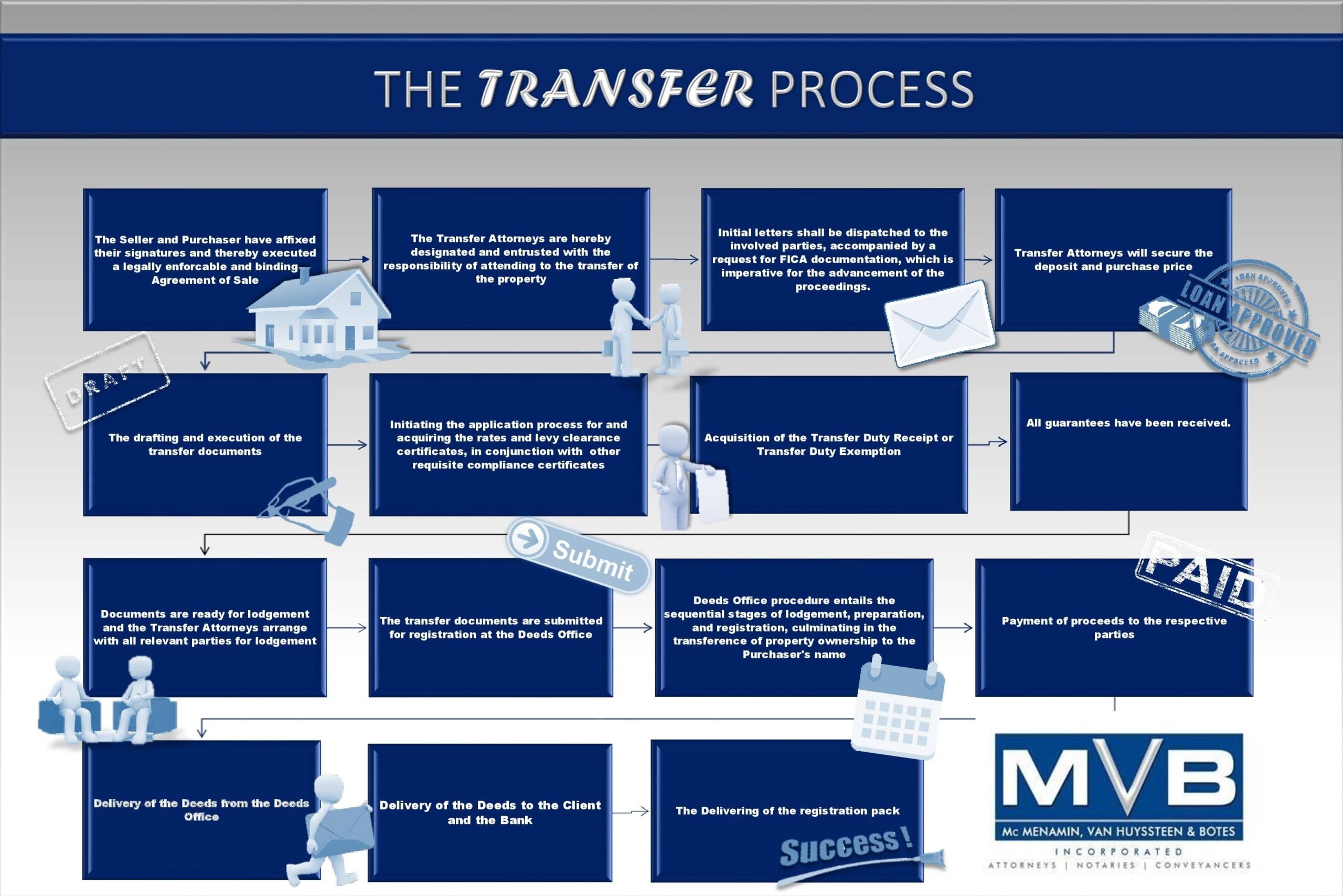

TRANSFER PROCESS UNVEILED: A COMPREHENSIVE STEP-BY-STEP GUIDE

Selling or purchasing a property can cause great distress whether you are a first time buyer or purchasing a property for the second or third time. Allow us to help lift the weight off your shoulders by walking you through the transfer process and what you can expect.

The agreement of sale must be reduced to writing

In terms of the South African property law an agreement of sale for the alienation of immovable property, whether it is by way of sale of the property, donation or otherwise, must be reduced to writing in order for the agreement to be enforceable and binding between the parties subject to the fact that all suspensive conditions, requirements and/or material terms have been complied with.

1. Provide the agreement of sale to the Transfer Attorneys

Once the agreement of sale has been signed between the parties, the signed agreement is sent to the transfer attorneys who will be attending to the registration of the property into the name of the Purchaser. The Transfer Attorneys will acknowledge receipt of the instruction, diligently peruse the Agreement of Sale and will request both parties to furnish them with several FICA (documents required in terms of the Financial Intelligence Centre Act, No 38 of 2001 and its regulations) and other necessary documentation.

2. First letters to be sent to the parties

The aforesaid FICA documentation will be requested by the transfer attorneys by sending out their initial letters to the parties involved in the transaction. The initial letters will also contain the following:

2.1 the Purchaser will be requested to pay the deposit, if applicable, by a certain date as set out in the Agreement of Sale, alternatively state a date by when the Purchaser have to provide confirmation that a bond has been approved and/or granted as well as the bond amount as set out in the Agreement of Sale;

2.2 the Seller will be requested to provide the transfer attorneys with the original title deed of the property, only in the event that no bond is currently registered over the property. If a bond is registered over the property, the Seller will be requested to provide the bond account number in order to proceed and request bond cancellation figures from the bond cancellation attorneys, who will be appointed to attend to the registration of the cancellation of the current bond over the property;

2.3 the Seller will also be requested to provide a copy of the municipal rates and taxes account, in order to request rates figures for payment and to subsequently obtain a rates clearance certificate for lodgement;

2.4 the Seller will also be requested to provide a copy of the levy/Home Owners Association account, if and whichever is applicable, in order to obtain the levy figures for payment and to obtain the levy clearance certificate.

3. Securing of the deposit and purchase price

Most Agreements of Sale provides that the purchase price is payable against transfer and registration of the property into the name of the Purchaser. This entails that the whole purchase price must be secured either by way of a cash payment, bond finance or both combined before the transfer attorneys can lodge the transfer documents at the Deeds office.

Where the purchase price is secured by way of bond finance or a combination of both, a suspensive condition is usually added to the Agreement of Sale. A suspensive condition is defined as a term or clause within the Agreement of Sale which stipulates that the Purchaser must obtain bond finance or bond approval before the lapse of a specified period of days or date. Upon the confirmation of the bond approval the Purchaser must advise the Transferring Attorneys of same as well as the amount the bond was approved for.

Should the Purchaser fail to obtain bond approval or fail to obtain bond approval for the balance of the purchase price as per the Agreement of Sale, the said agreement will cease to exist and will result in being unenforceable between the parties.

If the Purchaser obtains bond approval, bond attorneys will be appointed by the bank where the Purchaser obtained bond approval and the bond attorneys will become a party to the transfer process. The bond attorneys will provide the transfer attorneys with the bond amount and the amount available for guarantees, and request guarantee requirements for the cancellation of the existing bond registered over the property. In the event that the existing bond has to be cancelled, bond cancellation attorneys will be appointed to cancel the bond. The bond cancellation attorneys will provide a copy of the existing title deed to the transferring attorneys together with the bond cancellation figures and bond cancellation cost necessary to be paid prior to cancellation of the bond. The bond cancellation figures will in turn then be provided to the bond registration attorneys for purposes of issuing the necessary guarantees in order to cancel the bond over the property.

4. Drafting and signing of transfer documents

Upon receipt of the above requested documents, the transfer and bond attorneys will draft their respective documents for signing and make the necessary arrangement with all relevant parties to sign the same. The pro forma statement of accounts for the transfer and bond registration are provided to the Purchaser upon signing of the bond and transfer documents respectively.

5. Applying and obtaining rates and levy clearance certificates, together with other compliance certificates

Once the transfer documents have been signed, the transfer attorneys will apply and obtain rates and levy clearance figures which is due and payable by the Seller to the Agreement of Sale, unless otherwise agreed between the parties. Once the rates and levy clearance figures have been paid in full, the transfer attorneys will be provided with the rates and levy clearance certificates for lodgement in the Deeds Office. All compliance certificates as per Agreement of Sale must be provided by the Seller and/or Agent to the transfer attorneys, usually prior to lodgement.

6. Obtaining of Transfer Duty Receipt or Transfer Duty Exemption

In addition to the above, the transfer attorneys is required to lodge a Transfer Duty Receipt alternatively a Transfer Duty Exemption receipt. Transfer duty is payable and calculated on the purchase price and/or value of the property and in accordance with the table provided by the South African Revenue Services. That being said, Transfer duty, as at date hereof, will only become due and payable where the purchase price and/or value of the property is R1 100 001 or above R 1 100 001. There are however exemptions to Transfer Duty payable as set out in the Transfer Duty Act, 1949.

7. Receiving all guarantees

Prior to lodgement, the bond registration attorneys have to provide the transfer attorneys with the original guarantees which will secure the purchase price and to cancel the existing bond, whichever is applicable. The transfer attorneys will provide the bond cancellation attorneys with the guarantee/s to cover the bond cancellation figures and subsequently cancel the existing bond, if applicable. The bond cancellation cost can either be paid by way of an issued guarantee, an undertaking, or in payment, depending of the payment requirements of the bond cancellation attorneys. At this stage all suspensive conditions and requirements of sale have to be complied with.

8. Lodging of the transfer documents at the Deeds Office

Upon attending to the above, receipt of all relevant transfer and registration documentation as well as the transfer costs, the transfer attorneys will be ready for lodgement. The transfer attorneys will communicate and arrange lodgement with the bond and bond cancellation attorneys, if applicable, as simultaneous lodgement of all the deeds in the Deeds Office are required in order to proceed with registration of the property. In conveyancing jargon, the transfer attorneys will arrange the linking and lodgement date with the other attorneys involved in the transaction.

9. Deeds Office procedure, – lodgement, preparation and registration of the property into the name of the Purchaser

Lodgement is the first step in the Deeds Office process. The documents lodged will be checked with regards to any possible interdicts against the property where after the documents are distributed to various examiners to be examined for accuracy and compliance with the Deeds Office Act and Deeds Office regulations. The deeds will be examined on Level 1 by a junior examiner, on Level 2 by senior examiner and on Level 3 by a monitor. The aforesaid examination period takes approximately 7-10 working days, provided there is no delays. Provided no queries are raised or no rejections are received during the examination period, the documents will be provided to the conveyancers to make the necessary arrangements with all the simultaneous attorneys and conveyancers to prepare the documents for registration, (this stage is known as Preparation or “Prep”).

This stage means the Registrar will allow registration and the deeds may be held on ”Prep” for a maximum period of 5 working days, unless otherwise provided by the Deeds Office. At this stage the bond attorneys will also request and obtain their proceed to register the bond from the Bank. Furthermore, the bond cancellation attorneys will request the final bond cancellation figures for payment and their proceed to continue with the registration of the cancellation of the existing bond.

Once the matter is on “Prep” and all the simultaneous parties are ready for registration, the matter is put forward by all the involved conveyancers for registration. The day after the date of putting the deeds forward for registration, the matter will be ready to register.

On the date of the registration all the conveyers of the transaction will be available and appear at the Deeds Office to register all the Deeds. Once the Registrar signed all the documents, the property is registered into the name of the Purchaser.

10. Payment of proceeds

On receipt of the proceeds of the sale the transfer attorneys will finalise the final statement of accounts for the Seller and the Purchaser, which accounts will reflect the funds received and paid, any fees charged and relevant disbursements to the mater. The Seller and Purchaser should receive payment of monies due subsequently to the final statement of account within 1 (one) to 2 (two) days of registration.

11. Delivery of the deeds from the Deeds Office

After registration of the property into the name of the Purchaser, the Deeds Office will deliver the original title and bond deed and documents to each respective registration attorney after a period of 4 (four) to 6 (six) weeks after registration, depending on possible delays with data capturing and the microfilming in the Deeds Office.

12. Delivery of the Deeds to client and the Bank

After the transfer attorneys receive the original deeds from the Deeds Office, the original title deeds are then delivered to the Purchaser if no bond was registered over the property. In the event that a bond was registered over the property, the original title deed together with the bond deed must be delivered to the Bank, being the bondholder, for safekeeping.

13. Delivery of the registration pack

Once the transaction has been registered in the Deeds Office, the transfer attorneys send out a registration pack, confirming that the property was registered into the name of the Purchaser. This pack must be taken by the Purchaser to the relevant Municipality to open a rates account in the name of the Purchaser, and it should assist the Municipality with finalising the process as soon as possible.

Please take note that the above steps relate to a normal transfer and not for a divorce and/or deceased transfer, which include more steps and may take longer to register in the Deeds Office.

Understanding the timeline and possible delays to registration process

It is important to note that the transfer attorneys only attend to the transfer of the property from the Seller’s name into the name of the Purchaser. We work closely with other parties such as bond cancellation attorneys (if there is an existing bond to be cancelled over the property), bond attorneys (if the Purchaser is securing the purchase price by way of bond finance), and third parties like body corporates, home owners associations (for levy clearance certificates), municipalities (for rates clearance certificates) as well as SARS (for the obtaining of the Transfer Duty Receipt or Transfer Duty Exemption Receipt). As a result of all third parties involved in the transfer process, the time line cannot be determined. However, we as the transfer attorneys will always work efficiently and diligently in expediting the process.